February 28, 2023

Get Smart with Smart Beta ETFs

Traditional Index ETFs are often heralded as the best way to invest in the stock market. But what if there was a better way? Factor ETFs have the potential to outperform traditional market-cap weighted indices through bull and bear markets alike, and we will outline some of today’s best strategies.

The idea behind factor investing is to focus on specific drivers of return, beyond the average returns provided by the sector or asset class. Factor ETFs take an Index and apply additional filters to only include companies that meet certain criteria, depending on what factor is being considered.

Although many factor or multifactor strategies exist, a few have been proven to work especially well during inflationary or stagflationary periods and warrant the most consideration given the projected macro environment.

Value Factor ETFs

In recent years, it has been a point of debate that the S&P 500’s returns are too dependent on the results of just a handful of companies (primarily in tech-related sectors), and that investors may be taking on more exposure to these companies than they would have in previous decades.

As of February 7th, 2023, the information technology sector makes up +27% of the S&P Index (even after significant price compression in 2022), and this could make some investors nervous about overexposure.

A value factor ETF provides exposure to the factor by investing in companies that exhibit certain value characteristics such as:

- Low price-to-book ratio

- Low price-to-earnings ratio

- Low price-to-sales ratio

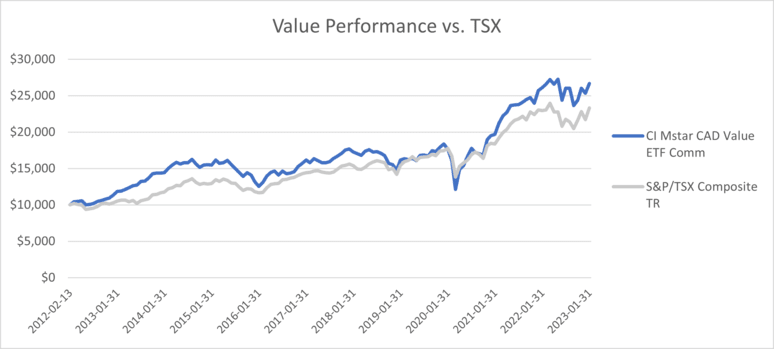

As an example, the CI Morningstar Canada Value Index ETF (FXM) provides exposure to the companies that meet certain valuation criterias and would exclude companies with lofty valuations that would be most at risk if market and economic conditions change.

The last 10-20 years’ worth of data shows long term outperformance of value strategies over the main index, in both the U.S and Canada, but primarily in Canadian markets over the last decade.

Source: Morningstar, as at January 31, 2023’

Dividend Growth Factor ETFs

Another popular style factor is a dividend growth strategy, which focuses on companies that are not only paying but also growing their dividends, based on historical evidence that this is related to better overall returns. There are several advantages to this particular strategy:

1. Helps investors keep up with inflation. Since the 1930s, dividends have provided roughly 40% of the total market returns, and close to 54% of the market returns during decades of high inflation such as in the ‘40s, ‘70s and ’80s.

2. Allows investors to earn yield in environments where capital gain returns are low or negative and can make the difference between a negative year and positive year in their portfolios.

3. Provides diversification to sectors beyond Real Estate, Utilities, and Financials, which historically have made up a large portion of dividend-oriented funds.

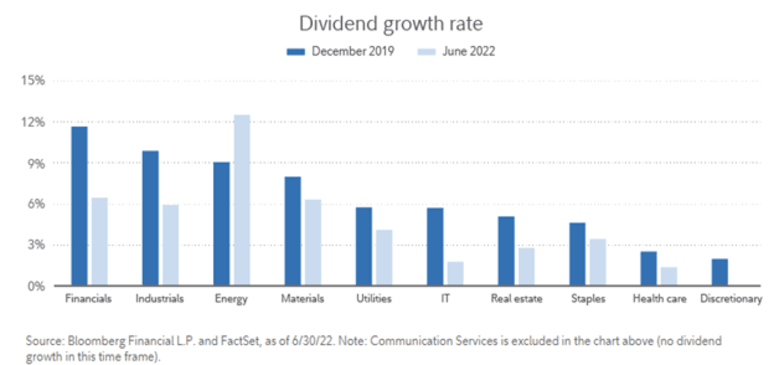

As an example, prior to 2008, firms in the banking sector accounted for about 30% of the S&P's yield. However, an increase in oil prices and a significantly leaner sector has allowed Energy companies to boost their dividends considerably over the last 3 years, while the other sectors have lowered the pace of increase.

The success of this factor mainly depends on the strategy’s ability to forecast which companies are likely to keep increasing their dividend yield. Once this is determined, the holdings are weighted based on their respective contribution to the overall yield of the portfolio.

Canadian investors looking to take advantage of a dividend growth strategy that offers a healthy allocation to the energy sector with an added quality factor tilt (after healthy allocation to the energy sector), can do so through an ETF such as the CI WisdomTree US Quality Dividend Growth Index ETF (DGR.B), which outperformed the S&P 500 by roughly 18% in 2022, and is off to a strong start in 2023.

While past performance may not be indicative of future returns, 2022 made for a good case study of which strategies and styles of investing are better positioned to withstand market stress and volatility. Investors wishing to gain exposure to a broad range of dividend growth factor ETFs, can visit our factor ETF lineup.

Momentum factor ETFs

The momentum factor focuses on increasing exposure to stocks or industries that have been outperforming and decreasing exposure to underperforming sectors. These strategies follow trends seen in the market, without necessarily trying to forecast where the inflows will be. They take the markets as is rather than as they should be and take the view that “if you can’t beat them, join them”.

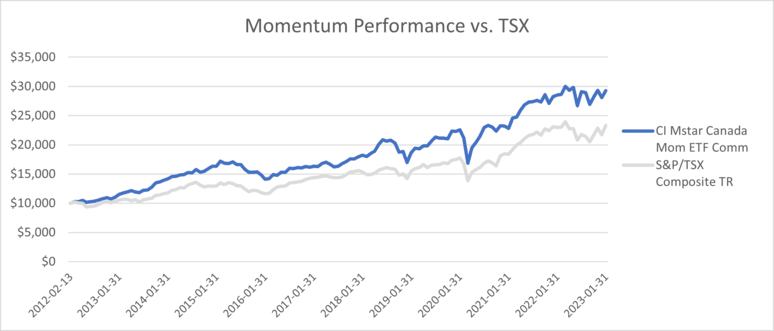

As it turns out, momentum strategies have been a main driver of returns over the past 20 years, both in North America and abroad.

Closer to home, the CI Canada Momentum Index ETF has had similar success, with outperformance in both good and bad years for the underlying index, as shown below:

Source: Morningstar, as at January 31, 2023’

Are factor strategies right for you?

Factor strategies are compatible with investors who want a more targeted exposure to a particular index and are looking to take advantage of a certain trend, be it dividend growth, quality, momentum, or a value-based approach. Given that factors are often in favour at different times and parts of the market cycle, it makes sense to incorporate multiple factors or a multi-factor strategy into your portfolio.

They provide a more managed approach to a passive index fund and aim to increase the returns that can be generated from the index. Beyond their proven ability to beat index returns long-term, factor strategies often do so with reduced volatility, and low fees, making it an excellent choice for DIY investors.

Investors looking to capture the benefits of factor or multifactor strategies can consult their financial advisor, or visit our list of ETFs for more information.

Glossary of Terms

Volatility: Measures how much the price of a security, derivative, or index fluctuates. The most commonly used measure of volatility when it comes to investment funds is standard deviation.

IMPORTANT DISCLAIMERS

Commissions, trailing commissions, management fees and expenses all may be associated with an investment in mutual funds and exchange-traded funds (ETFs). Please read the prospectus before investing. Important information about mutual funds and ETFs is contained in their respective prospectus. Mutual funds and ETFs are not guaranteed; their values change frequently, and past performance may not be repeated. You will usually pay brokerage fees to your dealer if you purchase or sell units of an ETF on recognized Canadian exchanges. If the units are purchased or sold on these Canadian exchanges, investors may pay more than the current net asset value when buying units of the ETF and may receive less than the current net asset value when selling them. Please read the prospectus before investing. Important information about an exchange-traded fund is contained in its prospectus. ETFs are not guaranteed; their values change frequently, and past performance may not be repeated. Returns of the Index do not represent the ETF’s returns. An investor cannot invest directly in the Index. Performance of the ETF is expected to be lower than the performance of the Index.

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies.

Morningstar® is a registered trademark of Morningstar, Inc. (“Morningstar”) Morningstar® CI Canadian Momentum Index ETF (the “Index”) is a service mark of f Morningstar and has been licensed for use for certain purposes by CI Global Asset Management (“CI GAM”). The securities of each CI Morningstar ETFs (the “ETFs”) are not in any way sponsored, endorsed, sold or promoted by Morningstar or any of its affiliates (collectively, ‘‘Morningstar’’), and Morningstar makes no representation or warranty, express or implied regarding the advisability of investing in securities generally or in the ETFs particularly or the ability of the Index to track general market performance.

The comparison presented is intended to illustrate the mutual fund’s historical performance as compared with the historical performance of widely quoted market indices or a weighted blend of widely quoted market indices or another investment fund. There are various important differences that may exist between the mutual fund and the stated indices or investment fund, that may affect the performance of each. The objectives and strategies of the mutual fund result in holdings that do not necessarily reflect the constituents of and their weights within the comparable indices or investment fund. Indices are unmanaged and their returns do not include any sales charges or fees. It is not possible to invest directly in market indices.

“WisdomTree®” and “Variably Hedged®” are registered trademarks of WisdomTree Investments, Inc. and WisdomTree Investments, Inc. has patent applications pending on the methodology and operation of its indexes. The ETFs referring to such indexes (the “WT Licensee Products”) are not sponsored, endorsed, sold, or promoted by WisdomTree Investments, Inc., or its affiliates ("WisdomTree"). WisdomTree makes no representation or warranty, express or implied, and shall have no liability regarding the advisability, legality (including the accuracy or adequacy of descriptions and disclosures relating to the WT Licensee Products) or suitability of investing in or purchasing securities or other financial instruments or products generally, or of the WT Licensee Products in particular (including, without limitation, the failure of the WT Licensee Products to achieve their investment objectives) or regarding use of such indexes or any data included therein.

The CI Exchange-Traded Funds (ETFs) are managed by CI Global Asset Management, a wholly-owned subsidiary of CI Financial Corp. (TSX: CIX). CI Global Asset Management is a registered business name of CI Investments Inc.

©CI Investments Inc. 2023. All rights reserved.