February 26, 2021

Expanding your Horizon: A Case for International Equities

The past decade has been quite prosperous for U.S. large-cap equities, and investors largely, haven’t had many reasons to invest beyond North America. Recency bias in investing is the tendency for investors to consider recent trends and extrapolate them into the future, but ignoring the long term value of international markets could mean missing out on some of the best run companies in the world!

Considering that certain international markets have better relative containment of COVID-19, and more favourable global trade pacts are expected under a Biden administration, there is an opportunistic case to be made for maintaining or adding a healthy allocation to developed international equities in a strategic portfolio today.

Let’s discuss some reasons why international equities look compelling.

1. International vs. U.S. markets – A story of cyclicality

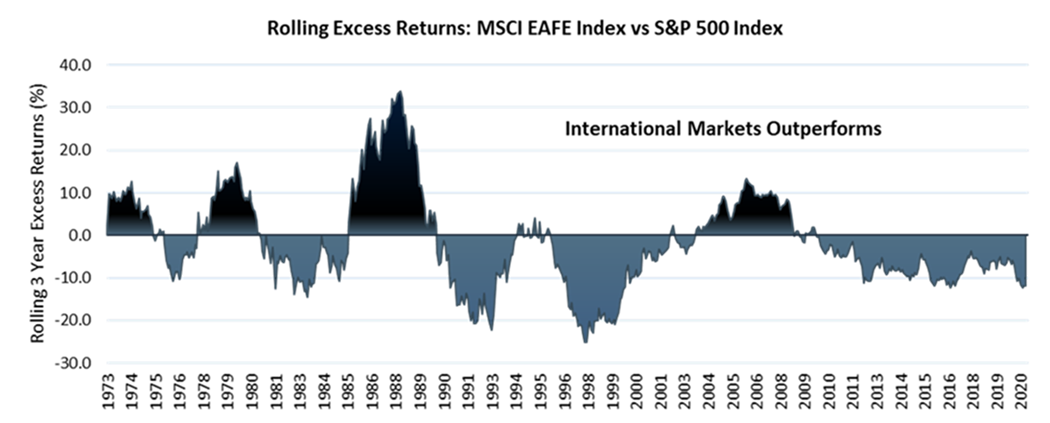

Recency bias aside, the outperformance of international markets vs. the U.S. is cyclical in nature (see chart below).

While U.S. equities have dominated international equities over the past decade, between 2000 and 2010, international markets delivered better returns than their U.S. counterparts amidst two market recessions.

Source: Morningstar Research Inc., as at December 31, 2020.

History tells us mean reversion seems likely at some point, and international ETFs may provide an outlet for taking some chips off the table after an unprecedented rise in U.S. markets.

2. How much international equity is too much?

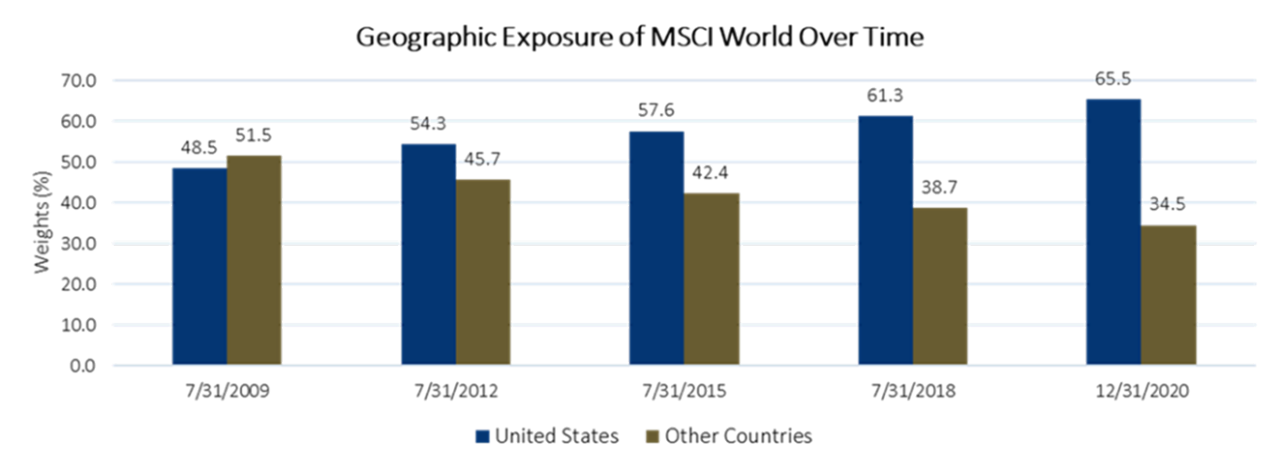

The exceptional run up in U.S. equities may have created situations in which investors’ portfolios have more U.S. exposure than they are aware of or comfortable with. For example, the weight of U.S. exposure within the MSCI World Index during the past 10 years has been on a steady rise. In 2009, the average weight of U.S. exposure within the MSCI World Index was less than 50%. Fast forward to the end of December 2020, and U.S. exposure was 66%. As a result, investors who have not been consistently rebalancing their portfolios may find themselves with larger allocations to U.S. equities and underweight allocations to international equities. It may be a good time to consider how much U.S. exposure you are comfortable with.

Source: Morningstar Research Inc., from July 31, 2009 to December 31, 2020.

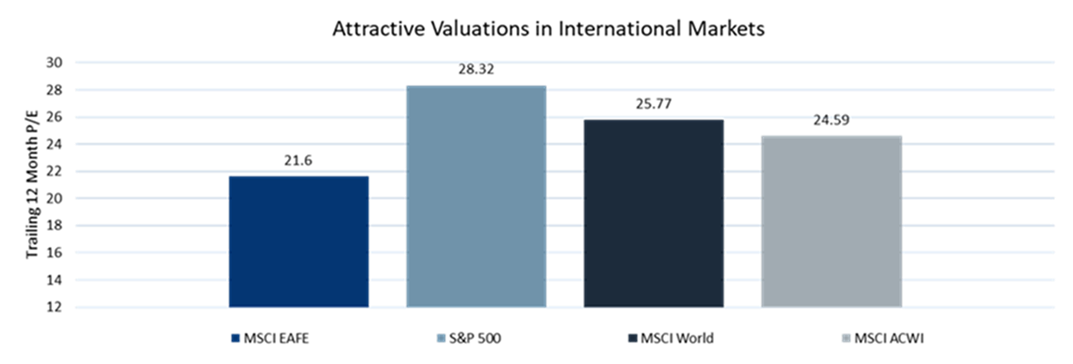

3. Valuation advantage in international ETFs

Developed international equities currently trade at attractive valuations relative to both U.S. and global markets. Valuation expansion will likely be a more significant tailwind for international market returns than U.S. market returns going forward.

Source: Morningstar Research Inc., as at December 31, 2020.

Accessing international markets with CI Global Asset Management

International markets are vast and deep, and investors looking to allocate to international equities may want to consider an active or multi-factor strategy.

CI Global Asset Management offers two distinct and compelling international strategies that have delivered strong-absolute and risk-adjusted returns:

- CI WisdomTree International Quality Dividend Growth Index ETF (IQD/IQD.B) is a multifactor smart beta strategy that invests in dividend-paying companies that use fundamental metrics such as return on equity (ROE), return on assets (ROA) and long-term estimated earnings growth.

- CI International Equity Growth Private Pool is an actively managed strategy that seeks to provide capital growth over the long-term by investing primarily in equity securities of issuers outside of North America with a focus on high-quality companies.

While it’s impossible to predict what the next decade will look like for international and U.S. markets, the importance of diversification, cyclicality of performance and attractive valuations all make international equities an appealing asset class.

About the Author

As Vice-President, Head of ETF Strategy, Nirujan’s primary responsibility includes working with the various departments within CI GAM to set and execute the ETF Sales Strategy and help promote the growth of the ETF business. Nirujan’s responsibilities also includes overseeing the ETF Sales Support team where he works alongside the sales team in assisting investors and advisors on ETF education and support. Nirujan brings a wealth of ETF knowledge, including ETF product management, indexing, factor research, ETF portfolio development, and has been involved in the launch of many ETFs in the Canadian marketplace. Prior to joining CI GAM, Nirujan held progressively senior roles with global asset managers Invesco and Horizons ETFs, where responsibilities included product management, product development and sales strategy in both the Canadian and U.S market. Nirujan holds a Bachelor of Commerce (Finance and Accounting) from Ryerson University and is a CFA Charterholder.

IMPORTANT DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in exchange-traded funds (ETFs). You will usually pay brokerage fees to your dealer if you purchase or sell units of an ETF on recognized Canadian exchanges. If the units are purchased or sold on these Canadian exchanges, investors may pay more than the current net asset value when buying units of the ETF and may receive less than the current net asset value when selling them. Please read the prospectus before investing. Important information about an exchange-traded fund is contained in its prospectus. The indicated rates of return are the historical annual compounded total returns net of fees and expenses payable by the fund (except for figures of one year or less, which are simple total returns) including changes in security value and reinvestment of all dividends/distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. ETFs are not guaranteed; their values change frequently, and past performance may not be repeated.

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies.

Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document.