April 14, 2022

Cybersecurity in the Digital Age

In today’s digital age, data has become a highly coveted resource. Cybercriminals have evolved to become more sophisticated in their attacks and data breaches. Meanwhile, the digital acceleration of the global economy has led to increased vulnerability for companies and governments alike.

The recent Russia-Ukraine conflict is a stark reminder of the devastation of war. Moreover, it has put a spotlight on the varied nature of attacks and demonstrates that armed conflict in the 21st century extends beyond physical warfare and into cyberspace.

The Impact of Cyberattacks

Over the course of the Russia-Ukraine conflict, there have been several suspected Russian cyberattacks that disrupted the Ukrainian government and private institutions. However, this is not the first time this has happened. In 2015, after the Russian invasion of the Crimean Peninsula, suspected Russian hackers managed to take down a power grid in Western Ukraine that left 230,000 residents without power.1 Not long after, in 2017, a Russian cyberattack using the NotPetya malware knocked out key Ukrainian infrastructure and quickly spread around the world impacting several multinational companies. All in all, the total damage was estimated to be more than $10 billion.2 Incidents such as these, highlight the severity and costs of cyberattacks in the modern era.

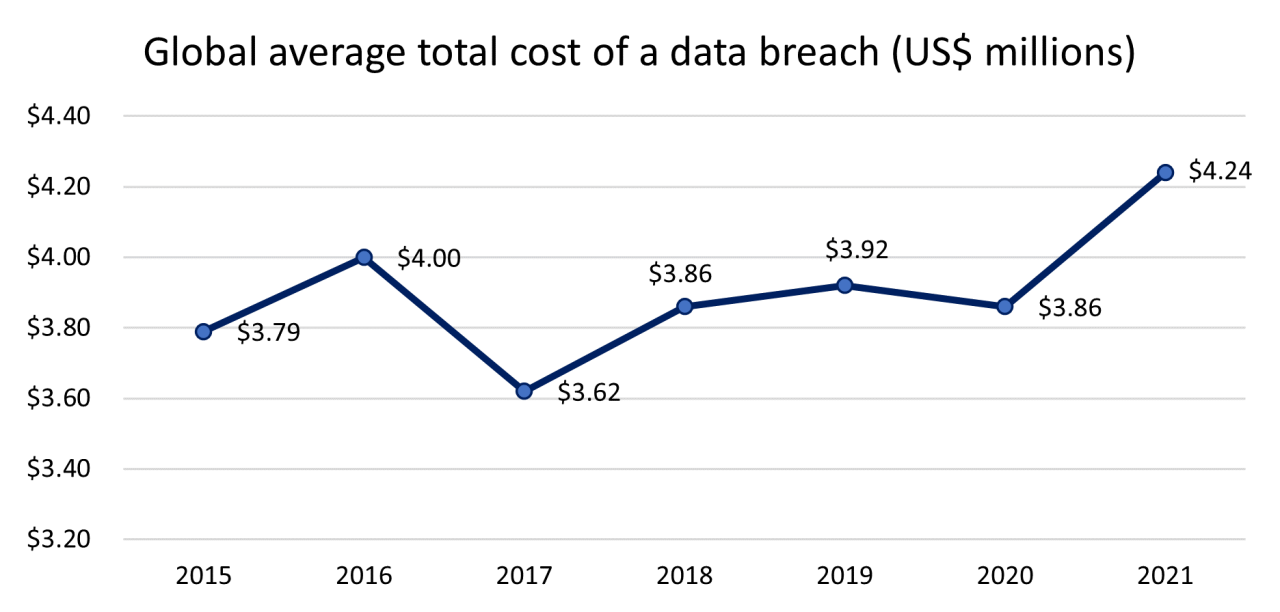

Recent high-profile cyberattacks on companies such as Facebook, Microsoft, and Equifax also emphasize the importance of strong cybersecurity. Additionally, the pandemic has led to an increase in both the volume and cost of cyber incidents as a greater percentage of the workforce move towards a digital environment. As shown in the below chart, the average cost of a data breach increased from $3.9 million in 2020 to $4.2 million in 2021.3 Given that more organizations will continue to adapt to a remote or hybrid operating model, it’s reasonable to assume that the risks of cyber incidents will remain elevated in the long run.

Source: IBM, “Cost of a Data Breach Report 2021”

Increased Spending on Cybersecurity

In response to the growing cyber threats, corporations and governments around the world have dedicated considerable resources and investments to cybersecurity. It has become a never-ending game of cat and mouse, as government organizations and companies must adopt a robust response plan to defend against the latest cyber threats.

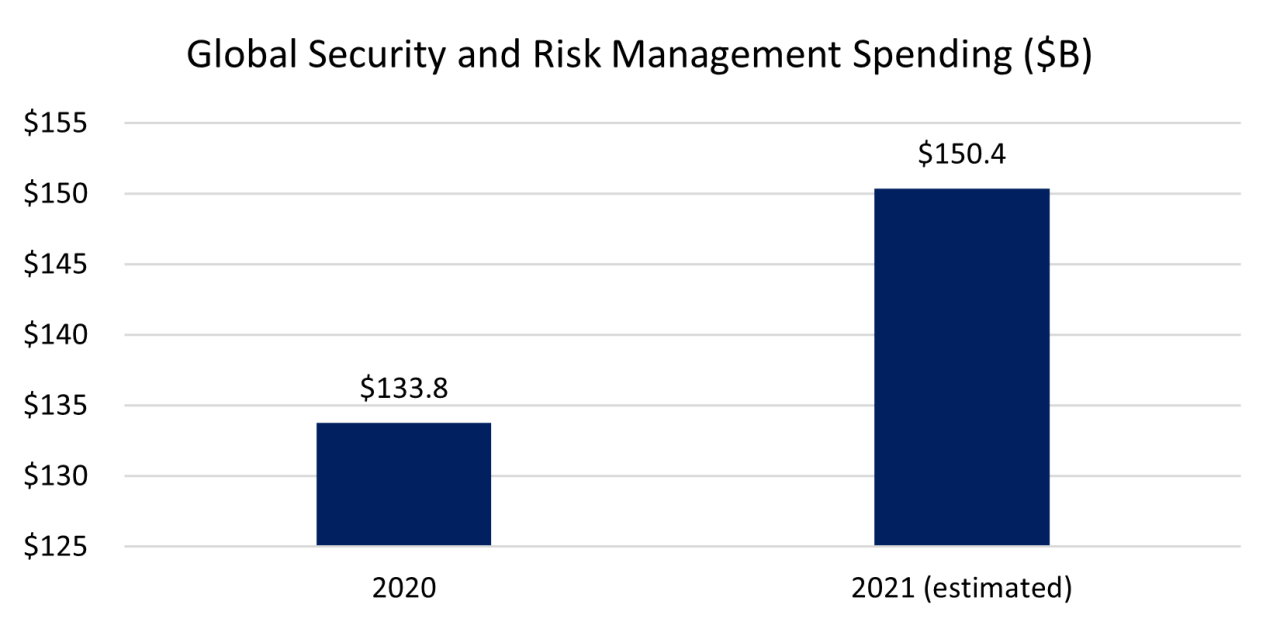

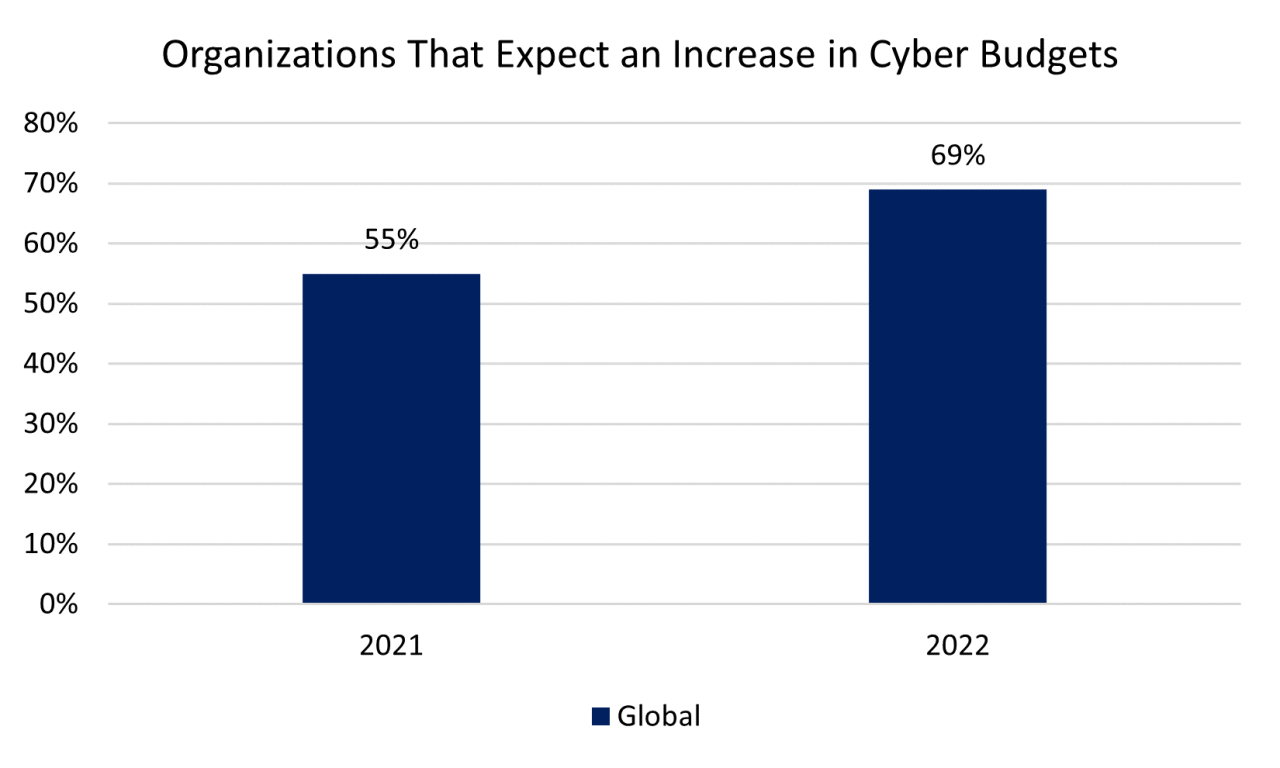

With that said, the amount of spending on cybersecurity has also increased significantly over the last several years and is expected to grow. Worldwide spending on cybersecurity is estimated to have increased by 12.4% in 2021 to reach $150.4 billion.4 In a recent survey, 69% of global organizations predict an increase in cyber spending in 2022 compared to 55% in 2021.5 Governments have also stepped up their cybersecurity spending. More recently, U.S. President Biden’s $5.8 trillion budget proposal includes $10.9 billion in cybersecurity funding – an 11% increase from last year.6

Source: Gartner, “Forecast: Information Security and Risk Management, Worldwide, 2019-2025, 1Q21 Update.”

Source: PwC, 2022 Global Digital Trust Insights, October 2021

Cybersecurity as an Investment Opportunity

With an increasing emphasis on the importance of cybersecurity, investors who may be looking for ways to invest in this theme can do so via the CI Digital Security ETF (CBUG). The ETF is one of the lowest-cost funds (0.40% management fee) in the space that provides targeted exposure to the world’s leading cybersecurity companies.

About the Author

Jaron Liu is a Director of ETF Strategy at CI GAM and is responsible for growing the ETF business by setting and executing the ETF sales strategy as well as supporting the ETF sales team. Prior to joining CI GAM, Jaron worked as an analyst within product management for one of the largest global asset managers where he focused on ETFs. Jaron graduated from the University of Waterloo with a degree in Honours Economics and is a CFA charter holder.

SOURCES

1 Harvard Business Review, “What Russia’s Ongoing Cyberattacks in Ukraine Suggest About the Future of Cyber Warfare”, March 7, 2022

2 The Brookings Institution, “How the NotPetya attack is reshaping cyber insurance”, December 1, 2021.

3 IBM, “Cost of a Data Breach Report 2021”

4 Gartner, “Forecast: Information Security and Risk Management, Worldwide, 2019-2025, 1Q21 Update.”

5 PwC, 2022 Global Digital Trust Insights, October 2021

6 The White House, “Budget of the United States Government, Fiscal Year 2023 – Information Technology and Cybersecurity Funding”

IMPORTANT DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in exchange-traded funds (ETFs). You will usually pay brokerage fees to your dealer if you purchase or sell units of an ETF on recognized Canadian exchanges. If the units are purchased or sold on these Canadian exchanges, investors may pay more than the current net asset value when buying units of the ETF and may receive less than the current net asset value when selling them. Please read the prospectus before investing. Important information about an exchange-traded fund is contained in its prospectus. The indicated rates of return are the historical annual compounded total returns net of fees and expenses payable by the fund (except for figures of one year or less, which are simple total returns) including changes in security value and reinvestment of all dividends/distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. ETFs are not guaranteed; their values change frequently, and past performance may not be repeated.

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies.

Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document.