October 27, 2021

Energy Gridlock: The Sign of Economic Slowdown?

Global energy issues have caught investors’ attention over the past month. China is rationing electricity, power plants in India are running out of coal and Europeans are paying sky-high prices for natural gas. While North America is in better shape, the global issues are contributing to higher energy prices here, including at the gas pumps. So, how did we get here and will it cause a broader economic slowdown?

The kink in the hose

The reasons for the shortages range from bad luck to bad policies. In Europe, calm winds have curtailed wind turbine electricity supply across the continent, whereas China’s problems stem from their reduction of coal imports from Australia. Other factors include a reduction in coal, oil and gas extraction caused by the pandemic and government policies to combat climate change.

A retro revival?

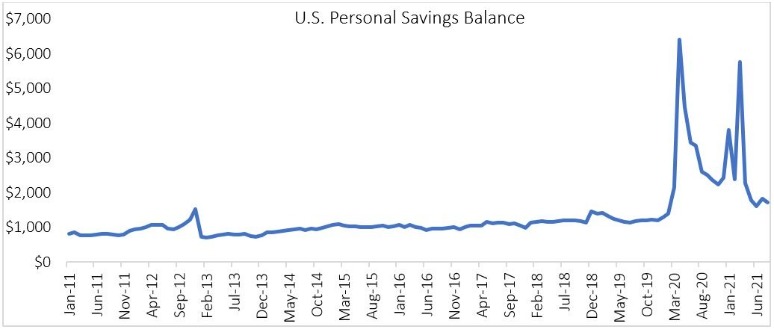

There are concerns that higher energy prices will start to constrain overall consumption and economic growth like it did in the 1970s. In our opinion, the comparisons to the 1970s are not well-founded for a few reasons. Firstly, the share of energy in consumers’ consumption baskets has fallen from 11% in 1960 to just 3% today. Secondly, consumers are still sitting on a pile of savings built up during the pandemic that could be released if the need arises.

Source: U.S. Bureau of Economic Analysis. As of August 31, 2021.

The root of the issue

The real reason we don’t foresee a 1970s-like recession is that most of these supply issues are solvable. In Europe’s case, they can import more gas from Russia, although politicians are probably reluctant to approve a pipeline that could be used as a political weapon. In China’s case, they can import more coal to ease the supply crunch. In India, they are ramping up domestic production targets.

In addition, higher energy prices increase the incentives for energy production, which will help balance supply. While we don’t expect a broader economic slowdown due to higher energy prices, we still believe the Organization of the Petroleum Exporting Countries’ (OPEC) supply discipline and recovering demand will keep the price of oil elevated into next year.

Our portfolio positioning on energy

As you know, we take a long-term view when it comes to our positioning strategy but do make tactical adjustments as opportunities arise. Therefore, we continue to hold an overweight position in the energy sector, which has benefitted our portfolio returns. More broadly, our call to overweight equity and simultaneously underweight bonds continues to reward investors. We maintain our core view that the COVID-19 situation will continue to improve, driving a strong recovery across many sectors.

For more information on our portfolios and investment strategies, visit our managed solutions page on the new ci.com website.

About the Author

Alfred Lam, Senior Vice President, Co-Head of Multi-Asset, joined CI GAM in 2004. He brings over 23 years of industry experience to his portfolio design, asset allocation, portfolio construction, and risk management responsibilities, which include chairing the multi-asset investment management committee and sizing investment bets to drive added value and manage risk. Alfred holds the CFA designation and an MBA from York University Schulich School of Business. He is a recognized leader in multi-asset investing in Canada. During his tenure, his team has won multiple investment awards, including the Morningstar Best Fund of Funds, and saw assets growing four-fold.

About the Author

Marchello Holditch, CFA, CAIA, Vice-President and Portfolio Manager, oversees CI's multi-manager, multi-asset investment programs. He is responsible for managing CI’s institutional and private client multi-asset portfolios and is a member of the CI Multi-Asset Investment Committee. Previously, Mr. Holditch led CI’s portfolio manager research and oversight function, where he was responsible for evaluating the investment managers of all CI funds. Prior to joining CI, Mr. Holditch worked at a major global consulting firm, where he assisted a wide variety of institutional clients with risk budgeting and asset liability modelling, as well as investment manager research and selection. He holds an Honours Bachelor of Mathematics degree in actuarial science from the University of Waterloo and is a CFA charterholder.

IMPORTANT DISCLAIMERS

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies.

The opinions expressed in the communication are solely those of the authors and are not to be used or construed as investment advice or as an endorsement or recommendation of any entity or security discussed.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what CI Global Asset Management. and the portfolio manager believe to be reasonable assumptions, neither CI Global Asset Management nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document.

CI GAM | Multi-Asset Management is a division of CI Global Asset Management. CI Global Asset Management is a registered business name of CI Investments Inc.

©CI Investments Inc. 2021. All rights reserved.

Published October 27, 2021