December 13, 2021

Life Insurance Sector Benefits from Rising Interest Rates

In the current investment climate, investors have a variety of competing factors to consider when making investment decisions. One market factor that’s become reality is the rise in interest rates.

At the start of the pandemic, central banks around the world lowered interest rates to mitigate the impacts of slower economic growth, triggering record lows in 10-year U.S. Treasury yields. Now, Treasury yields are at last starting their rebound in response to economic re-openings and whispers of interest rate hikes in 2022 and beyond. This has created a new tilt in the investment environment, prompting investors to search for solutions that can not only navigate, but capitalize on rising rate scenarios.

One compelling solution is life insurance companies. Let’s look at three key reasons to consider investing in the life insurance sector as interest rates rise through the lens of our CI U.S. & Canada Lifeco Income ETF (TSX:FLI).

1. Positive correlation to interest rates

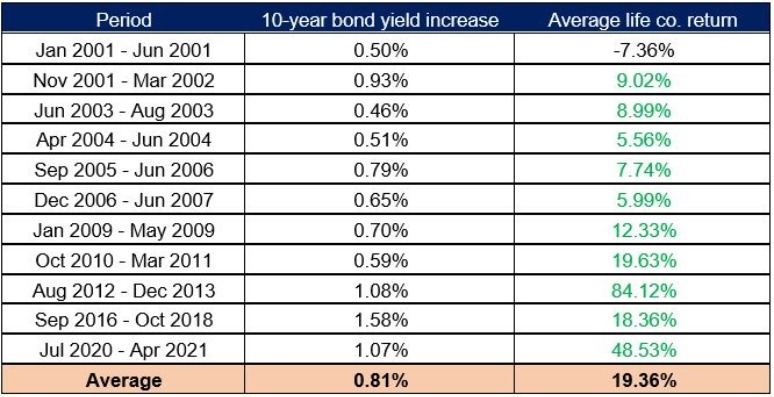

Unlike most sectors, life insurance companies are positively correlated to interest rate movements. One reason is that insurers often reinvest policyholder premiums into bond instruments, allowing them to profit when Treasury yields increase. To demonstrate, the below chart highlights key historical timelines when yields have risen. In Canada, the average life insurance company generated returns of 19% when Bank of Canada 10-year bond yields increased (an average of 81 bps).

Performance of Canadian life insurance companies in rising yield environments

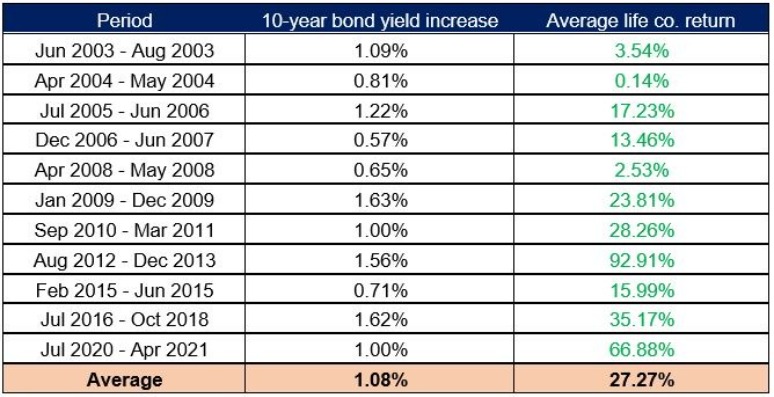

And U.S. life insurance companies generated returns of 27% on average when U.S. Treasury 10-year yields increased (an average of 108 bps).

Performance of U.S. life insurance companies in rising yield environments

Average LifeCo Return: Top 10 largest North American life insurance companies, as measured by market capitalization, as of October 31, 2021, have been used for calculation purposes.

Canada: Great West Life, Manulife and Sun Life.

U.S.: Lincoln National, Principal Financial, MetLife, Globe Life, Unum Group, Prudential Financial and Aflac.

Source: Morningstar Direct and Bank of Canada, as of October 31, 2021

2. Affordability compared to the banks

When most Canadians think of sound and reliable stocks, they immediately look to the banks. But the popularity of bank stocks for their stable returns also makes them more expensive on a relative basis. Over the last five years, insurers have looked increasingly more attractive next to Canadian banks, which currently trade at a 38% premium over FLI.

Plus, higher interest rates can have a positive impact on both banks and life insurance companies. This presents a unique opportunity for investors to benefit from rising interest rates through exposure to a discounted insurance sector instead of the big banks.

3. Higher yields and income potential

FLI is made up of an equally weighted portfolio of the 10 largest Canadian and U.S. life insurers for exposure to companies with strong market shares and yield potential. So far in 2021, the life insurance sector has outperformed the broader equity market while trading at near historic lows. In the third quarter of 2021, the sector was trading at a 62% discount to the S&P 500 Index, a 47% discount to the financials sector and a 13% discount to its own 5-year average.

FLI also has the added benefit of using a covered call strategy which can provide smoother risk-adjusted returns. As part of our covered call strategy, a call option is written on up to 25% of the portfolio to generate income and help reduce volatility. Meanwhile, the remaining 75% is exposed to upside growth potential for enhanced yield versus the fund’s benchmark.

Reasons to invest

After decades of declining interest rates, their rise has become a reality. Through income generation, attractive valuations and improving growth potential, exposure to life insurance companies through FLI could be an effective way for investors to benefit from rising interest rates.

About the Author

As Vice-President, Head of ETF Strategy, Nirujan’s primary responsibility includes working with the various departments within CI GAM to set and execute the ETF Sales Strategy and help promote the growth of the ETF business. Nirujan’s responsibilities also includes overseeing the ETF Sales Support team where he works alongside the sales team in assisting investors and advisors on ETF education and support. Nirujan brings a wealth of ETF knowledge, including ETF product management, indexing, factor research, ETF portfolio development, and has been involved in the launch of many ETFs in the Canadian marketplace. Prior to joining CI GAM, Nirujan held progressively senior roles with global asset managers Invesco and Horizons ETFs, where responsibilities included product management, product development and sales strategy in both the Canadian and U.S market. Nirujan holds a Bachelor of Commerce (Finance and Accounting) from Ryerson University and is a CFA Charterholder.

IMPORTANT DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in exchange-traded funds (ETFs). You will usually pay brokerage fees to your dealer if you purchase or sell units of an ETF on recognized Canadian exchanges. If the units are purchased or sold on these Canadian exchanges, investors may pay more than the current net asset value when buying units of the ETF and may receive less than the current net asset value when selling them. Please read the prospectus before investing. Important information about an exchange-traded fund is contained in its prospectus. ETFs are not guaranteed; their values change frequently, and past performance may not be repeated.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what CI Investments Inc. and the portfolio manager believe to be reasonable assumptions, neither CI Investments Inc. nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies.

Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Investments Inc. has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document.

Morningstar Direct is a web-based research platform ideal for developing, selecting, and monitoring investments, including Open End Funds, Separate Accounts, Exchange-Traded Funds, Stocks, Variable Annuity Products, Stocks and much more. Optimize the investment process by applying our multi-asset data to advanced portfolio analytics and performance reporting.

CI Global Asset Management is a registered business name © CI Investments Inc. 2022. All rights reserved.

Published August 4, 2022

B''

italic

- sddasd

- sdas

- sdada